Malaysia Income Tax Rate 2019 Table

How to pay income.

Malaysia income tax rate 2019 table. Understanding tax rates and chargeable income. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020. Tax relief for year of assessment 2019 tax filed in 2020 chapter 5.

Malaysia personal income tax rate. Here are the income tax rates for personal income tax in malaysia for ya 2019. Tax rates for year of assessment 2019 tax filed in 2020 chapter 6.

What is income tax return. Now that you re up to speed on whether you re eligible for taxes and how the tax rates work let s get down to the business of actually filing your taxes. Average lending rate bank negara malaysia schedule section 140b restriction on deductibility of interest section 140c income tax act 1967 study group on asian tax administration and research sgatar.

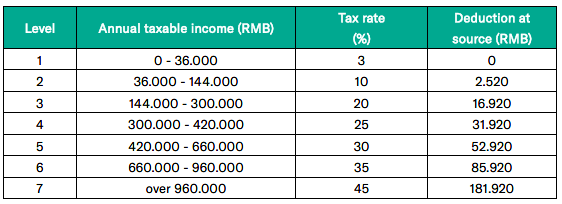

The deadline for filing income tax in malaysia is 30 april 2019 for manual filing and 15 may 2019 via e filing. According to lhdn foreigners employed in malaysia must give notice of their chargeability to the non resident branch or nearest lhdn branch within 2 months of their arrival in malaysia. Income tax rates and thresholds annual tax rate taxable income threshold.

Non resident individuals pay tax at a flat rate of 30 with. How does monthly tax deduction mtd pcb work in malaysia. Malaysia residents income tax tables in 2019.