Kwsp Withdrawal For Education

Amount eligible for withdrawal.

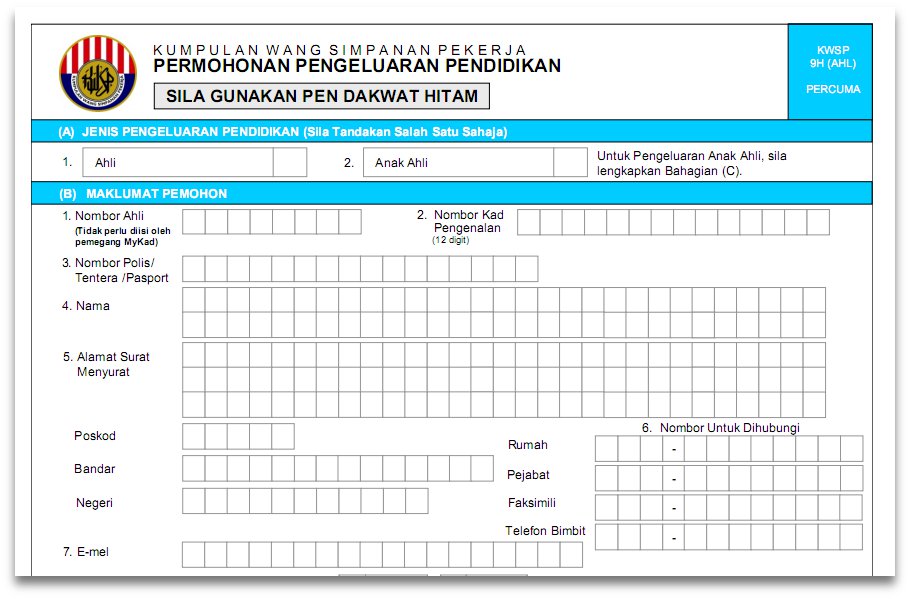

Kwsp withdrawal for education. Hello prashant substract the epf amount received in an year from the income received in the same financial year. 1 2 pf withdrawal for education paragraph 68k. 1 5 pf withdrawal for repayment of housing loan paragraph 68bb.

12000 in epf and contributed rs. 1 1 pf withdrawal for marriage paragraph 68k. Withdrawals from epf a c for repayment of home loan.

Savings in account 2 can be withdrawn under specific conditions. If your annual income in 2010 2011 is 3 95 000 and you ve received rs. If you are an employees provident fund epf contributor and plan on using your epf funds to finance your own or your children s education at local higher learning institutions heis you can now submit your withdrawal applications online using e pengeluaran.

30 of your total epf savings will be in this account from which you can make pre retirement withdrawals for purposes stated above including housing education and medical. The required supporting documents may vary for the 1st and 2nd withdrawal. Epf education withdrawal to fund your education.

18000 in lic nsc or any other scheme then your tax breakup would be 3 95 000 30000 3 65 000. 1 4 pf withdrawal for construction purchase of house land paragraph 68b. So it is crucial to compile all the required documents to ensure a smooth application process.

Employees provident fund account ii withdrawal scheme for education. 1 epf partial withdrawal rules 2020. To facilitate epf members in preparing for a comfortable retirement the epf allows you to make a partial or full withdrawal from your savings to meet the specific retirement related needs that are in line with the epf s current policies.

Epf allows pre retirement withdrawals which in a way enhance the retirement wellbeing of our members. Although it is a controversial statement to blindly assume higher education alone is the key to a successful life or career nowadays withdrawing your epf account ii to pursue higher education is allowed by kwsp. Additional documents required for withdrawal for member s or member s children s education.

1 3 pf withdrawal for medical treatment paragraph 68j. You can expand your withdrawal limit to your children. This scheme allows epf members to withdraw from their account ii for further studies in local or overseas institutions for their children or themselves.

If you are prepaying the debt loan you should have completed at least 10 years of service. Epf withdrawal for education including ptptn. To avail this provision you need to submit loan certificate statement to your employer along with from 31 form for epf partial withdrawal.